สระเดี่ยวคือ

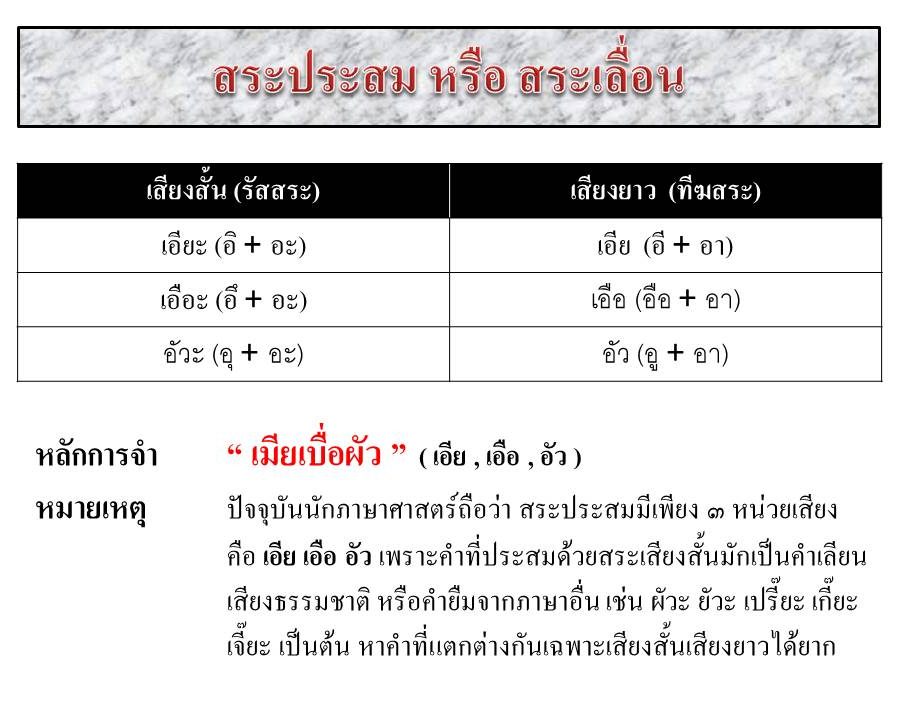

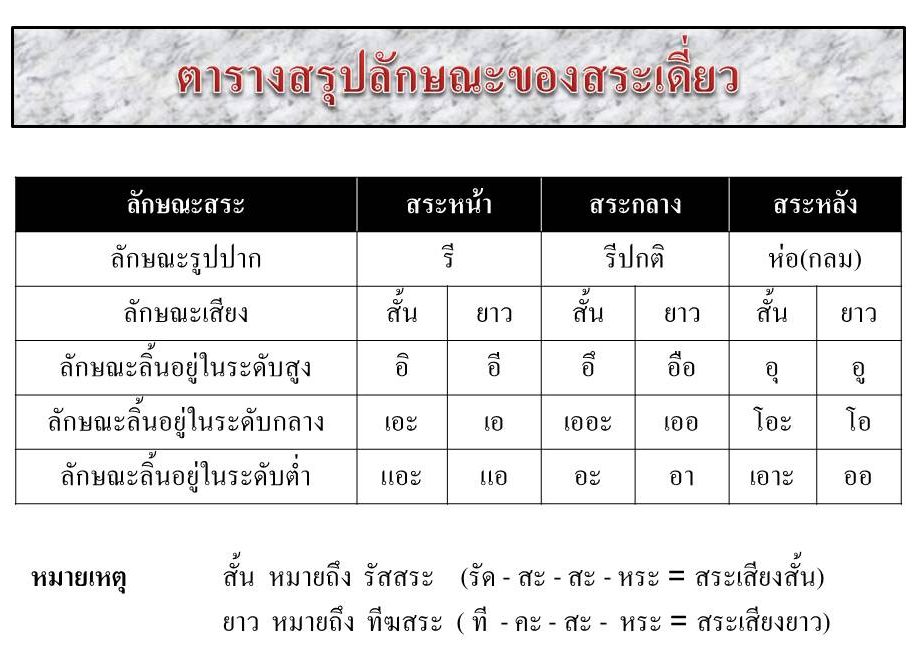

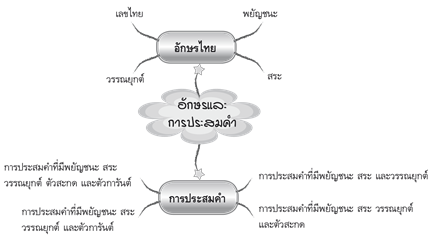

เสียงภาษาหมายถึงเสียงที่ผู้คนใช้ในการสื่อสารระหว่างกัน เสียงในภาษาที่กำลังพัฒนาขึ้นอยู่กับอวัยวะที่สร้างเสียง อวัยวะที่สร้างเสียง ได้แก่ ปาก กราม ฟัน ลิ้น เพดานปาก ริมฝีปาก สระเดี่ยวคือ กล่องเสียง หลอดลม และปอด เสียงมี 3 แบบ คือ ไทย 1) เสียงกลิ้งหรือเสียงจริง 2) พยัญชนะหรือรูป และ 3) เสียง . หรือเพลงปิดปากข้างหนึ่ง แล้วมีเสียงหึ่งๆ สำเนียงยาวๆ มีสระอะไรในภาษาไทยบ้าง? สระยาว (theka สระ) จากการรวมกันของสระ ia + ua, สระ U + ua แบบฝึกหัดสระเดี่ยว จากการรวมกันของ U + สระ U จากการรวมกันของเสียงสั้นที่จุดเริ่มต้นของสระ Ua

(สระรัสเซีย). เป็นผลมาจากการรวมสระอิสระ + e e สระ นั่นคือ สระผสม + ราชาสระ U + สระ ดังนั้นภาษาไทยจึงใช้น้อยลง ดังนั้น นักภาษาศาสตร์จึงไม่ถือว่าสระสั้นข้างต้นเป็นสระ สระเดี่ยว ตัวอย่าง เหลือสระยาว 3 ตัว มีทั้งหมด 18 สระ รวมกับสระผสม 6 ตัว มีสระเพียง 24 ตัว จริงไหม? กลับมาที่โรงเรียนครูสระผม 32 โอ้อีก 8 สระหายไปไหน? คำตอบคือ ยกเว้นตัวอักษรยี่สิบสี่ตัวนั้น มีกลุ่มอื่นอีก 8 กลุ่มที่ไม่แสดงในไฟล์เสียงด้านบน เนื่องจากการรวมเข้าด้วยกัน สระเสียงเดี่ยว สระจึงออกเสียงเหมือนกันทุกประการ นอกจากนี้ยังมีพยัญชนะผสม สิ่งที่เรียกว่า “สระเสริม”

สระเดี่ยว สระประสม ดูยังไง

สำหรับสระ 8 ประเภทนี้คือ “Am, Ai, Aoi, Ao, Ru, Ru, h” และเราเพิ่มสระพิเศษ 8 ตัวเพื่ออธิบายว่าสระใดที่สร้างขึ้น สระเดี่ยวคือ โครงสร้างคงที่คืออะไร? ให้ Am = a + m (สระพยัญชนะ m.ma), Ai = a + y แบบฝึกหัดสระเดี่ยว (สระไม่ออกเสียง Y. yak), Ai = A + Y (Y. พยัญชนะ

กว้าง), A = A + W. และพยัญชนะ W. ring) R = R + U สระเดี่ยว สระประสม (ซึ่ง R. Rue ผสมกับสระ) Ru = R + U (R. E มีสระ) h = L + UEE (R. 1 ครั้งที่เสียงพูด) หรือไม่มีความหมายว่า สระเดี่ยว ตัวอย่าง คือ ครั้งหนึ่งเสียงที่เรียกว่าพยางค์ หรือถ้าได้ยินสองครั้งจะเรียกว่า 2 พยางค์ เช่น ใน

สระเดี่ยวคือ อะไรบ้าง

ประวัติศาสตร์ Vetika มีสี่พยางค์และอ่านว่าสวรรค์เป็นสะวันนา มี 2 พยางค์ เสริม) เรียกว่า “คาถา” เช่น คำว่า “ทหาร” สระเดี่ยวคือ (ออกเสียง). tahan) – พยัญชนะหัว T – สระ สระ A (ตา) แบบฝึกหัดสระเดี่ยว และสระ A (ข่าน) – ประกอบด้วยสระทั่วไป (ta) และ

เสียง ระหว่างดวงดาว (HAN) – มีฮันในพยางค์ Hay พยัญชนะที่สอดคล้องกับส่วนการสะกดและส่วนช่องว่าง สระเดี่ยว สระประสม ภาษาไทยมี 21 พยัญชนะ และ 21 พยัญชนะใช้เป็นพยัญชนะท้าย สระเดี่ยว ตัวอย่าง หรือเขียนได้เพียง 8 เสียง พยัญชนะท้าย

สระเดี่ยว ตัวอย่าง มีวิธีการจำอย่างไรบ้าง

พยางค์เรียกว่า สะกด 1 แม่กก แบ่งเป็นพยางค์ไม่มีพยัญชนะ พยางค์ที่ลงท้ายด้วยแม่ 2 แม่กก เป็นพยางค์ที่มีเสียงเค สระเดี่ยวคือ หลังพยางค์ชอบปวดห้องน้ำ 3.พยางค์เป็นพยางค์ที่ลงท้ายด้วยพยางค์ พยางค์ที่ลงท้ายด้วยพยางค์ เช่น อาทิตย์นั่ง พยางค์ที่ลงท้ายด้วยพยางค์เช่น ครุฑ พยางค์ที่ลงท้ายด้วยพยางค์เช่น วงเล็บปีกกา ขนมกลม อาศรม 8 ใหม่ หลังพยางค์เหมือน y ท้ายพยางค์เสียงเหมือนกล้วยท้ายพยางค์ที่ 9 แบบฝึกหัดสระเดี่ยว แม่กู่-เมี้ยว ไข่เจียว เกลียวขึ้น สะกดไม่ตรงกัน การสะกดของเราดูเหมือนถูก

ต้อง เช่น “วันอาทิตย์” สะกด “T” แต่ออกเสียงว่า “แม่กก” – “สมปอง” อ่านว่า “แม่กก” เขียนว่า “ช่อ” – “ลาซา” “เกาะ” . แต่ออกเสียงว่า May Cooks ภาษาไทยมีเสียงสระ 32 ตัว สระเดี่ยว ตัวอย่าง แบ่งเป็นสระสั้น (kik) และสระยาว (เช่น สระ) ea / a-ae/ o-oh/ah-of/ eh-er คือการรวมกันของเสียงสองเสียงที่คล้ายกัน สองประเภท: ia(i+a) – ea(e+a) ue(eee+a) – ue(u+a) ua(u+a) – ua(u+a) สระมีดังนี้: ด้วย สระเสียงเดี่ยว สระอีกครั้ง : ah (a+m) ai(a+y) ai(a+y) ah(a+w) r(r+uh) r(r+uh) ฦ(l+suh) ฦr(l+yes) ในกลุ่ม

สระเดี่ยวมีกี่เสียง ที่เราควรรู้

ไฟล์นี้ ไฟล์เสียงนี้มีไฟล์เสียงแบบสั้น ยกเว้นการทดสอบการรู้จำคำพูด แต่ละคำที่มีสระจะมีช่องว่างรอบพระไตรปิฎก สระเดี่ยวคือ ตรงกันข้าม การได้ยินเสียงลมพัดพามาทั้งปีติและความกลัว แบบฝึกหัดสระเดี่ยว กระจกที่โกรธแค้นบังคับให้เขาอยู่กับแกะ เคี้ยว

กระดูกไก่เหมือนสุนัข คำใดมีสระเสียงยาว ถ้าเส้นสีแดงนำไปสู่ข้าวบนถนน อัญญา สระเดี่ยวมีกี่เสียง บ็อกเซอร์ สิกเกล้า มีไม้เท้าสีน้ำเงิน ชาวบ้านยังคงบูชาพระองค์ สระเดี่ยวเสียงสั้น คนจีนมีไม้เท้าที่ถวายเกียรติแด่พระเจ้าในวันสุดท้ายของวันที่ห้า g คือคำตอบที่

สระเดี่ยวเสียงสั้น ฝึกวิธีออกเสียง

ถูกต้อง คำต่อไปนี้เป็นการรวมกันของสระสั้นและสระ เหล่านี้เรียกว่าเสียงผสม สระเดี่ยวคือ หน่วยการออกเสียง a ถูกวางและย้ายไปที่ระดับสระอื่น (สระสองตัวที่มีสระเดียวกัน) แบบฝึกหัดสระเดี่ยว สระ U + A, สระ Oua และสระ U + A สระที่มีสระเพิ่มเติมสามตัว:

สระ uaume, สระ Ua, สระ Oua, Oua udaume ใน Udaume I ฝนไม่ค่อยตก สระเดี่ยวมีกี่เสียง ยกโทษให้ฉัน sira sira ทางเลือก , ดนตรี, เลือด, ความเป็นทาส, เพื่อน, กิน, หัก, อ่อนแอ, เหนื่อย, เป็นสนิม, จมูก, สระเดี่ยวเสียงสั้น แข็งแรง, โกรธ, หัว, เจ็บ, ลวดหนาม,

สระเดี่ยวคือ อะไร มาเรียนรู้กันเลย

โซ่,ความดัน การสังเคราะห์และการออกเสียง ลำดับนี้เป็นเรื่องปกติหลังจากอ่านและรวมคำต่างๆ ต่อไปเราจะพิจารณาวิธีการตรวจสอบ จุดประสงค์คือเพื่ออำนวยความสะดวกในการออกเสียง สระเดี่ยวคือ พยางค์ภาษาเกาหลีใช้เมื่อคำแรกหรือพยางค์ลงท้ายด้วยตัวอักษร และคำต่อไปเป็นพยัญชนะที่ขึ้นต้นด้วยตัวอักษร eung ที่เกี่ยวข้องกับคำนี้ สมมติว่าเสียงเป็นพยัญชนะตัวแรกของอักษรตัวถัดไป แบบฝึกหัดสระเดี่ยว แต่ถ้าคำแรกมีตอนจบ 2 แบบ หรือคำแรกมีพยางค์ ให้เขียนด้วยคำนำหน้า คำแรกและอักษรตัวที่สองเป็น

อักษรตัวแรกของอักษรอื่น คำในภาษาเกาหลีส่วนใหญ่ออกเสียง ตรวจสอบการสะกดคำแรกและเสียงแรกของคำถัดไป ใบงานสระเดี่ยว สระประสม การออกเสียงเปลี่ยนเสียงไทยเป็นเสียงมนุษย์ที่แสดงความเป็นตัวคุณ เสียงอะไรอยู่ในคำ? ขึ้นอยู่กับอวัยวะที่สร้างเสียง ริมฝีปาก ริมฝีปาก ฟัน ลิ้น คอหอย คอหอย กล่องเสียง หลอดลม และปอด แม้ว่าจะมีเสียงโมโนโฟนิก 18 เสียง สระเกินคือ แต่มีเพียง 24 เสียง ขึ้นอยู่กับอวัยวะที่สร้างเสียง เมื่อฉันมาโรงเรียน ครูบอกว่ามีสระ 32 ตัว และสระที่เหลืออีก 8 ตัว Ans นอกจากสระ 24 ตัวนี้ ยัง

สระเดี่ยวคือ ใบงานสระเดี่ยว สระประสม ท่องจำอย่างไร

มีสระอีก 8 ตัวที่ไม่มีเสียงบน เหตุผลที่เพิ่มเป็นเพราะเสียงเหล่านี้มีความคล้ายคลึงกัน นอกจากนี้ยังมีพยัญชนะ สระทั้ง 8 ตัวนี้เรียกว่า “สระเสริม” ได้แก่ ” คือ พยัญชนะ สระเดี่ยวคือ คุณคิดว่าพวกเขาจะรวบรวม? ไอ ใช้สำหรับเขียนคำในภาษาบาลีและสันสกฤต มี 2 พยางค์ขึ้นต้นและออกเสียงว่า “oi” เขียนตาม “y” เรียกว่า “a” เพราะออกเสียงเพียง 1 พยางค์ แบบฝึกหัดสระเดี่ยว ซึ่งหมายความว่าการสะกดถูกต้อง ในกรณีของภาษาบาลีหรือสันสกฤตตามด้วยคำอื่นๆ เช่น ‘hen’, ‘vai’ ควรออกเสียงตัวอักษร Y เสมอ เพราะมี

การใช้คำเดียวกันนี้อยู่แล้ว คำเหล่านี้มักใช้ในภาษาไทย เช่น สระ สระ ภาษาถิ่น สวยกว่าในรูป ดังนั้นจึงสามารถใช้แทนกันได้และสามารถใช้วัสดุไม้ได้เท่านั้น ใบงานสระเดี่ยว สระประสม คำสันสกฤตที่ใช้ก่อนหรือหลัง เช่น ซานย่าแดง หัวใจ นาริตะ หลงตัวเอง เป็นต้น ประกอบด้วยพยัญชนะที่คล้ายกัน เช่น ราบาลี คำสันสกฤต ฮินดี และคำสแลงบางคำ เช่น พริชนา คฤหาสน์ สระเกินคือ ภาษาอังกฤษ (Pyanma of English) เป็นต้น มันถูกใช้ในคำภาษาบาลีและสันสกฤตบางคำที่เน้นพยางค์สุดท้าย เช่น pakiram nilamani

คำถามที่พบบ่อย (FAQ)

มีต้นกำเนิดในลำคอและส่งผลต่อส่วนต่างๆ ของปาก เช่น คอ เหงือก ฟัน และปาก และสร้างเสียงที่โดดเด่น มีอาหารไทย 21 เสียง และ 44 รูป

เมื่อพูดสระหรือพยัญชนะ เสียงและพยัญชนะเป็นเพลง ประโยคภาษาไทยมี 5 คำ